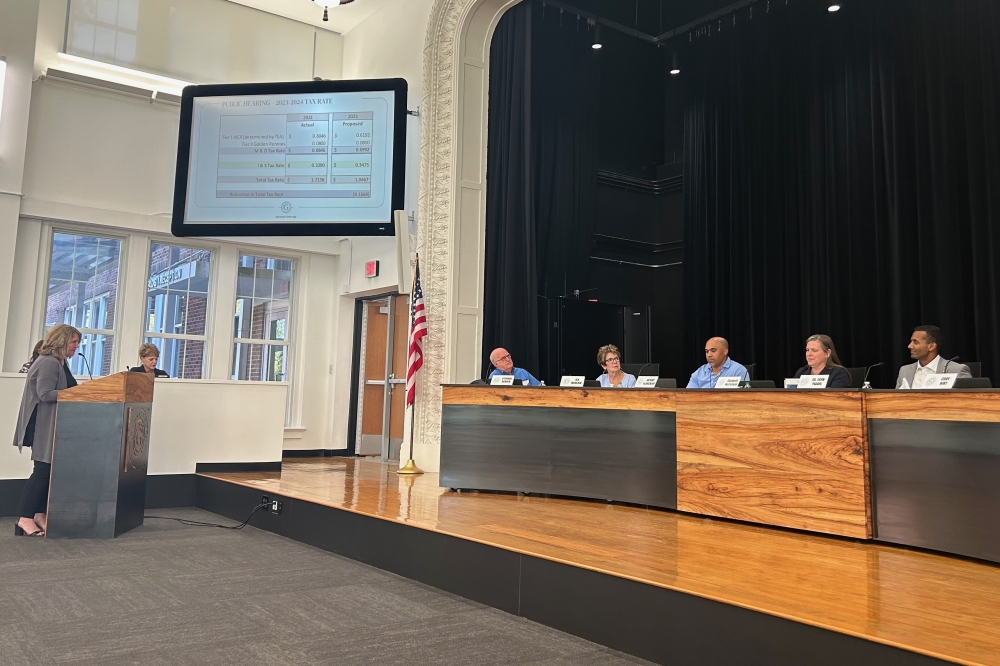

Property Tax Rate For Georgetown Tx . Visit texas.gov /propertytaxes to find a link to your local property tax database. the city’s fy2024 property tax rate is $0.374 per $100 of assessed valuation. The city of georgetown is $212,636,271. property tax amount = ( tax rate ) x ( taxable value of property ) / 100. Is this my total tax rate? proposed property tax rates 2024. the nnr tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year. No, the city is only. The williamson central appraisal district handles the. Property taxes are billed in october of. Debt obligation secured by property tax. property tax rate comparison. This notice concerns the 2024 property tax rates for city of georgetown. property tax rates in city of georgetown.

from communityimpact.com

This notice concerns the 2024 property tax rates for city of georgetown. the nnr tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year. The williamson central appraisal district handles the. proposed property tax rates 2024. Is this my total tax rate? property tax rates in city of georgetown. property tax amount = ( tax rate ) x ( taxable value of property ) / 100. The city of georgetown is $212,636,271. Debt obligation secured by property tax. Property taxes are billed in october of.

Tax rates, chaplains, school marshals 3 ISD stories to

Property Tax Rate For Georgetown Tx property tax rate comparison. Visit texas.gov /propertytaxes to find a link to your local property tax database. The city of georgetown is $212,636,271. the nnr tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year. Debt obligation secured by property tax. This notice concerns the 2024 property tax rates for city of georgetown. property tax amount = ( tax rate ) x ( taxable value of property ) / 100. the city’s fy2024 property tax rate is $0.374 per $100 of assessed valuation. Is this my total tax rate? Property taxes are billed in october of. No, the city is only. property tax rates in city of georgetown. proposed property tax rates 2024. property tax rate comparison. The williamson central appraisal district handles the.

From www.youtube.com

1984 Model Home Perry Homes Low Tax Rate TX YouTube Property Tax Rate For Georgetown Tx Visit texas.gov /propertytaxes to find a link to your local property tax database. No, the city is only. the city’s fy2024 property tax rate is $0.374 per $100 of assessed valuation. property tax amount = ( tax rate ) x ( taxable value of property ) / 100. Is this my total tax rate? This notice concerns the. Property Tax Rate For Georgetown Tx.

From itrfoundation.org

Property Tax Protection Through Local Government Limits ITR Foundation Property Tax Rate For Georgetown Tx No, the city is only. The williamson central appraisal district handles the. Visit texas.gov /propertytaxes to find a link to your local property tax database. Debt obligation secured by property tax. property tax amount = ( tax rate ) x ( taxable value of property ) / 100. the nnr tax rate enables the public to evaluate the. Property Tax Rate For Georgetown Tx.

From georgetownwatch.blogspot.com

Property Taxes Levied by City of Property Tax Rate For Georgetown Tx The city of georgetown is $212,636,271. Visit texas.gov /propertytaxes to find a link to your local property tax database. Property taxes are billed in october of. property tax amount = ( tax rate ) x ( taxable value of property ) / 100. property tax rates in city of georgetown. No, the city is only. the nnr. Property Tax Rate For Georgetown Tx.

From www.cashreview.com

State Corporate Tax Rates and Brackets for 2023 CashReview Property Tax Rate For Georgetown Tx Debt obligation secured by property tax. proposed property tax rates 2024. No, the city is only. Property taxes are billed in october of. the nnr tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year. This notice concerns the 2024 property tax rates for city of georgetown. The. Property Tax Rate For Georgetown Tx.

From www.costanalysts.com

7 Best Alabama Franchise Opportunities in 2024 Property Tax Rate For Georgetown Tx the nnr tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year. Property taxes are billed in october of. the city’s fy2024 property tax rate is $0.374 per $100 of assessed valuation. The williamson central appraisal district handles the. Debt obligation secured by property tax. Visit texas.gov /propertytaxes. Property Tax Rate For Georgetown Tx.

From www.slideserve.com

PPT Steven Brewer Tips For Building a Home When Moving to Texas Property Tax Rate For Georgetown Tx The city of georgetown is $212,636,271. the city’s fy2024 property tax rate is $0.374 per $100 of assessed valuation. No, the city is only. Property taxes are billed in october of. Debt obligation secured by property tax. This notice concerns the 2024 property tax rates for city of georgetown. proposed property tax rates 2024. property tax rates. Property Tax Rate For Georgetown Tx.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate For Georgetown Tx Is this my total tax rate? Property taxes are billed in october of. Visit texas.gov /propertytaxes to find a link to your local property tax database. Debt obligation secured by property tax. No, the city is only. the nnr tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year.. Property Tax Rate For Georgetown Tx.

From www.rismedia.com

Property Tax Rates Fell Slightly in 2022, Analysis Finds — RISMedia Property Tax Rate For Georgetown Tx property tax rates in city of georgetown. property tax rate comparison. Property taxes are billed in october of. No, the city is only. Is this my total tax rate? The city of georgetown is $212,636,271. the nnr tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year.. Property Tax Rate For Georgetown Tx.

From georgetowntax.com

Tax Help Tax Consulting Services Texas Jackson CPA Property Tax Rate For Georgetown Tx Is this my total tax rate? property tax rate comparison. The williamson central appraisal district handles the. property tax amount = ( tax rate ) x ( taxable value of property ) / 100. property tax rates in city of georgetown. Property taxes are billed in october of. The city of georgetown is $212,636,271. proposed property. Property Tax Rate For Georgetown Tx.

From taxfoundation.org

County Property Taxes Archives Tax Foundation Property Tax Rate For Georgetown Tx Is this my total tax rate? property tax amount = ( tax rate ) x ( taxable value of property ) / 100. property tax rates in city of georgetown. the city’s fy2024 property tax rate is $0.374 per $100 of assessed valuation. Debt obligation secured by property tax. Visit texas.gov /propertytaxes to find a link to. Property Tax Rate For Georgetown Tx.

From taxfoundation.org

County Property Taxes Archives Tax Foundation Property Tax Rate For Georgetown Tx the nnr tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year. The city of georgetown is $212,636,271. property tax rate comparison. property tax amount = ( tax rate ) x ( taxable value of property ) / 100. the city’s fy2024 property tax rate is. Property Tax Rate For Georgetown Tx.

From www.texasrealestatesource.com

How Do Property Taxes Work in Texas? Texas Property Tax Guide Property Tax Rate For Georgetown Tx Visit texas.gov /propertytaxes to find a link to your local property tax database. the nnr tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year. property tax amount = ( tax rate ) x ( taxable value of property ) / 100. the city’s fy2024 property tax. Property Tax Rate For Georgetown Tx.

From georgetownpropertylistings.com

Property Tax Rates and DC Real Estate Property Listings Property Tax Rate For Georgetown Tx Debt obligation secured by property tax. The williamson central appraisal district handles the. the city’s fy2024 property tax rate is $0.374 per $100 of assessed valuation. Is this my total tax rate? Visit texas.gov /propertytaxes to find a link to your local property tax database. property tax amount = ( tax rate ) x ( taxable value of. Property Tax Rate For Georgetown Tx.

From cmi-tax.com

Texas Property Tax Rates Cantrell McCulloch, Inc. Property Tax Advisors Property Tax Rate For Georgetown Tx Property taxes are billed in october of. property tax rate comparison. This notice concerns the 2024 property tax rates for city of georgetown. The williamson central appraisal district handles the. No, the city is only. Debt obligation secured by property tax. Is this my total tax rate? the city’s fy2024 property tax rate is $0.374 per $100 of. Property Tax Rate For Georgetown Tx.

From communityimpact.com

ISD proposes lower tax rate, using state funding to offset Property Tax Rate For Georgetown Tx Is this my total tax rate? Property taxes are billed in october of. No, the city is only. property tax rates in city of georgetown. property tax amount = ( tax rate ) x ( taxable value of property ) / 100. the nnr tax rate enables the public to evaluate the relationship between taxes for the. Property Tax Rate For Georgetown Tx.

From exogijrog.blob.core.windows.net

Property Tax Rate Sonoma Ca at Lynn Nguyen blog Property Tax Rate For Georgetown Tx Is this my total tax rate? proposed property tax rates 2024. the city’s fy2024 property tax rate is $0.374 per $100 of assessed valuation. the nnr tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year. property tax rates in city of georgetown. No, the city. Property Tax Rate For Georgetown Tx.

From unicornmoving.com

Travis County Property Tax Guide 💰 Travis County Assessor, Rate Property Tax Rate For Georgetown Tx Is this my total tax rate? The williamson central appraisal district handles the. the nnr tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year. The city of georgetown is $212,636,271. property tax rate comparison. property tax rates in city of georgetown. property tax amount =. Property Tax Rate For Georgetown Tx.

From www.texasrealestatesource.com

Lowest Property Taxes in Texas 5 Counties with Low Tax Rates Property Tax Rate For Georgetown Tx This notice concerns the 2024 property tax rates for city of georgetown. Debt obligation secured by property tax. Property taxes are billed in october of. Is this my total tax rate? the city’s fy2024 property tax rate is $0.374 per $100 of assessed valuation. The city of georgetown is $212,636,271. property tax amount = ( tax rate ). Property Tax Rate For Georgetown Tx.